Accelerating unit growth alongside flat revenues signals a structural shift toward ultra-low-cost cellular IoT, reshaping vendor economics and design choices. The dominance of LTE Cat.1 bis and China/India volume means global device makers will increasingly align hardware roadmaps and certifications to these ecosystems. Emerging DRAM constraints around smart modules could slow high-end industrial digitalization and favor simpler architectures or non-cellular alternatives. At the same time, early U.S. 5G RedCap migration foreshadows a more regionally fragmented cellular IoT technology landscape.

China, India and LTE Cat.1 bis fuel volumes, while pricing pressure, DRAM constraints and 4G-to-5G transitions reshape the market outlook

Key Highlights:

- Overall strong shipment growth: 19% YoY growth in 2024, 23% in 2025

- China and India drive shipment growth. NB-IoT spot-demand in Europe in 2025

- DRAM supply disruption impact high-end IoT modules (SOM/smart module, 5G/4G applications) in 2026-2027

- End-use expands not only for industrial/commercial, but also for consumer-type applications

- Reforming supply chain to address geopolitical matters

- Chinese suppliers’ dominance, and consolidation in cellular IoT chip and module supply chain

- 4G to 5G (eRedCap) migration in the USA

- LTE Cat.1 bis is becoming fundamental to IoT connectivity globally (outside USA)

Overall shipments and revenue

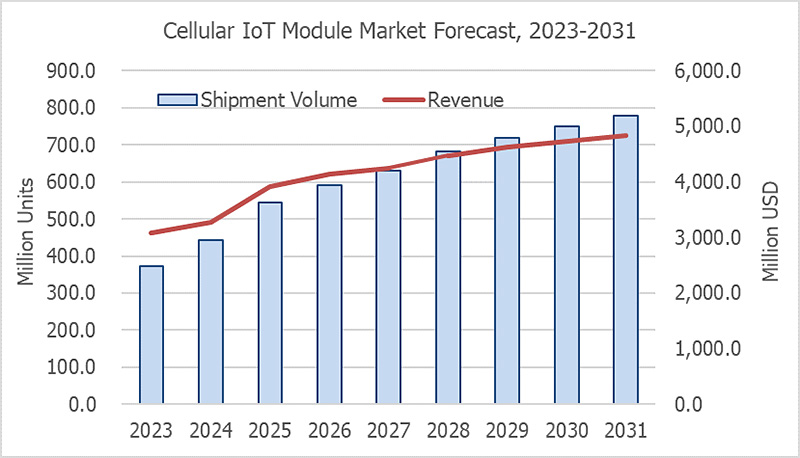

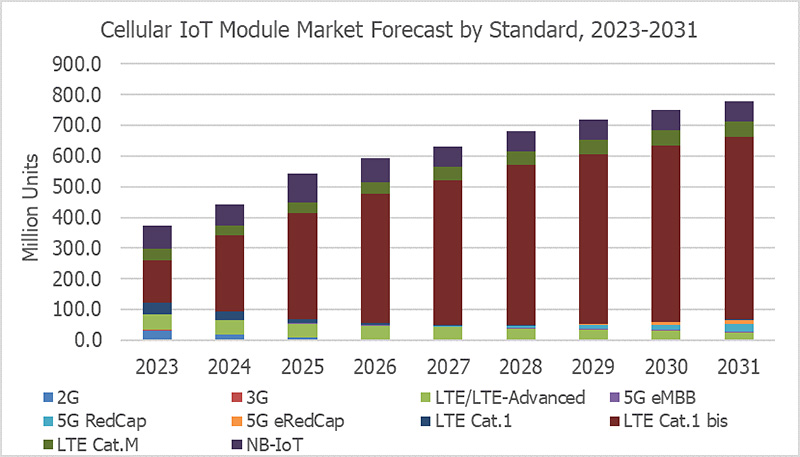

The cellular IoT module market is expected to reach 544 million units and USD 3.93 billion in revenue in 2025. Shipments are forecasted to grow by 23% in 2025, driven by several different factors: India market expansion, new use case in China and Europe, recovery from inventory correction in the western market. However, rapid growth in China and India, along with increased adoption of LTE Cat.1 bis and NB-IoT, will continue to pressure ASPs, limiting overall revenue growth in 2024–2025.

In 2026, shipment growth will slow to 8.8%. India and China will remain key demand drivers, while European NB-IoT shipments will decline as penetration peaks. At the same time, DRAM supply shortages and rising component costs will negatively affect demand for 4G/5G and smart modules.

The exact impact of DRAM shortages on the cellular IoT module market remains uncertain. Still, any smart device relying on legacy DDR3/DDR4 -especially Linux/Android-based systems or imaging applications- may face supply constraints and significant price increases by 2027.

-

4G/5G smart modules (SOM):

Products such as smart handhelds, smart POS, smart cameras, drones, and robotics will be among the most affected—particularly 4G smart modules that use 2–3GB of LP-DDR4. -

4G/5G module-based devices:

Industrial routers/gateways, high-end IP cameras, traditional industrial PCs, and industrial terminals are also expected to be impacted.

New use cases driving growth

Regulatory-driven demand

-

China: e-bike tracker (LTE Cat.1 bis):

New regulations require GNSS tracking for all new e-scooters to monitor battery safety. With 60–65 million e-scooters shipped annually, this policy will generate substantial LTE Cat.1 bis demand over the next two to three years. -

Spain: Emergency traffic light system (NB-IoT):

Spain now mandates an in-vehicle emergency light device using GNSS and NB-IoT. This rule generated demand for approximately 30 million NB-IoT modules in 2025 and 10 million units in 2026. Several European countries are reviewing similar regulations, though no formal plans have been announced.

Smart home applications

- China’s ecosystem is rapidly developing smart home devices—such as air conditioners, home appliances, and outdoor home IP cameras using LTE Cat.1 bis. Due to extremely low module prices and data tariffs in China, device makers are choosing LTE Cat.1 bis over Wi-Fi to ensure continuous data collection.

Cellular technology migration

LTE Cat.1 bis continues to expand globally, reaching 63% of total cellular IoT module shipments in 2025. As legacy 2G/3G networks sunset across many regions, LTE Cat.1 bis is becoming the default connectivity standard for mass-market IoT devices.

Cellular LPWA technologies account for 24% of the market in 2025, but their share is expected to decline gradually. LTE Cat.M shipments stagnated during 2024–2025 due to oversupply but are set to recover from the second half of 2025, with roughly 15% shipment growth projected for 2026. NB-IoT has matured and begun to contract in China, while seeing a temporary boost in Europe during 2025–2026 driven by Spain’s emergency-light regulation.

5G remains niche in cellular IoT market, representing just 0.4% of total shipments. Broader adoption of 5G RedCap and eRedCap is expected in 2027–2028, supported by (1) U.S. operators’ transition plans toward all-5G networks and (2) the arrival of low-cost Chinese 5G RedCap chipsets.

4G to 5G migration

AT&T and T-Mobile US plan to phase out 4G services and completely migrate to 5G networks. AT&T is taking the most aggressive approach, halting new 4G device and module certifications by 2025. T-Mobile is expected to follow within the next two to three years. These network roadmaps make the U.S. market the earliest adopter of 5G RedCap and eRedCap modules. On the other hand, no other countries or operators have concrete plans to sunset 4G networks yet.

Long-life IoT devices—such as smart metering and automotive telematics—are expected to be among the first to transition to 5G-based (or 6G-IoT, depends on the timing) connectivity.

Cellular chipset and module suppliers

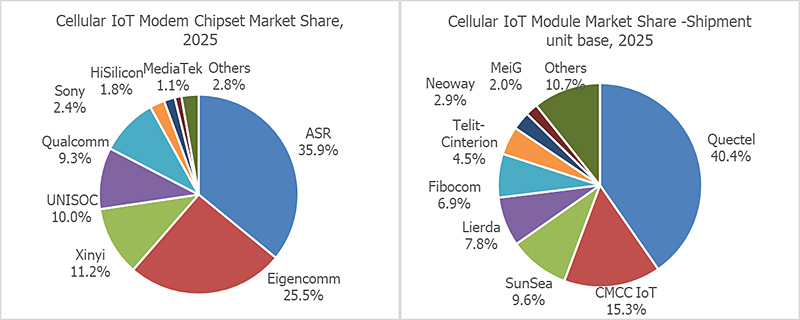

As low-end technologies dominate the cellular IoT market, Chinese vendors hold an overwhelming lead—around 90% share in the module market and 85% in the cellular chipset market.

Cellular module suppliers

In the module segment, China Mobile IoT, SunSea, and Lierda expanded their share in 2025. China Mobile IoT and Lierda gained domestic share through aggressive low-cost strategies, while SunSea increased NB-IoT shipments in Europe. Intense price competition continues to drive consolidation in China, prompting strategic shifts among many suppliers. Companies such as Quectel, Fibocom, SunSea, Lierda, MeiG, Neoway, and MobileTek are increasingly focusing on more profitable overseas markets or diversifying into adjacent businesses such as PCBA/ODM or IoT cloud platforms.

Non-Chinese module vendors saw a rebound in 2025 as inventory issue eased. Despite the strong momentum of Chinese suppliers, non-China vendors are expected to maintain small, but stable position in segments related to infrastructure, national security, and government-relation businesses in Western markets.

To address the geopolitical issue, major Chinese module makers have established alternative corporate structures—Wireless Mobility, Eagle Electronics, and Rolling Wireless—to maintain access to Western market.

India has seen new local players in the cellular module market recently, driven by geopolitics and a growing block-economy. Among them, Cavli Wireless has emerged as the largest local supplier with roughly 10% share in India.

Cellular IoT chipset suppliers

The top five chipset suppliers—ASR, Eigencomm, Xinyi, UNISOC, and Qualcomm—held a combined 92% share. Chinese suppliers maintain a strong lead in low-end segments such as LTE Cat.1 bis, NB-IoT, and 5G RedCap, but have limited presence in high-end 5G eMBB. There are no Chinese suppliers in LTE Cat.M, which the market is concentrated in Western market.

In 2025, ASR, Eigencomm and Xinyi gained market share respectively, while Qualcomm and UNISOC experienced decline. In 2026, HiSilicon is expected to grow rapidly, taking share from Eigencomm and ASR.

In 5G RedCap chipset segment, HiSilicon holds an early lead. However, Eigencomm, ASR, and potentially several Chinese start-ups could gain share after 2027 with introduction of low-cost 5G RedCap chipset.

The post Cellular IoT Modules Market Outlook 2025-2026: Strong Growth in 2025, Structural Pressures Ahead appeared first on IoT Business News.